CFP® Certification

According to FPSB global consumer research, clients who work with CFP® professionals experience a better quality of life, greater financial confidence and resilience, along with higher satisfaction in their financial situations.

INTERNATIONAL STANDARDS

CFP® professionals have met rigorous education, examination, and experience requirements, and commit to upholding the standards of practice in holistic financial planning.

ETHICAL PRACTICES

CFP® professionals commit to a Code of Ethics and to putting clients’ interests first.

LIFELONG LEARNING

CFP® professionals commit to learn continuously, grow and pursue professional excellence throughout their careers.

Key Benefits of CFP® Certification

The CERTIFIED FINANCIAL PLANNER® professional credential is the most desired and respected global certification for those

seeking to demonstrate their commitment to competent and ethical financial planning practice.

Enhanced Credibility and Trust Global research shows Consumers gave CFP® professionals high marks on honesty and integrity and on placing the client’s interests first.

Career Growth and Success as you unlock new opportunities, enhance your earning potential, and build a thriving financial practice.

Comprehensive Financial Knowledge as you gain deep expertise to provide well-rounded, client-focused financial advice.

Global Recognition and Reach as CFP certification is globally recognised, with the growing community of 230648 CFP professionals in 28 territories worldwide.

Competitive Edge & Advantage as demand rises for holistic financial planning, giving CFP® professionals an edge over other advisors.

Diverse Employment Opportunities in financial services, entrepreneurship, journalism, and many other fields.

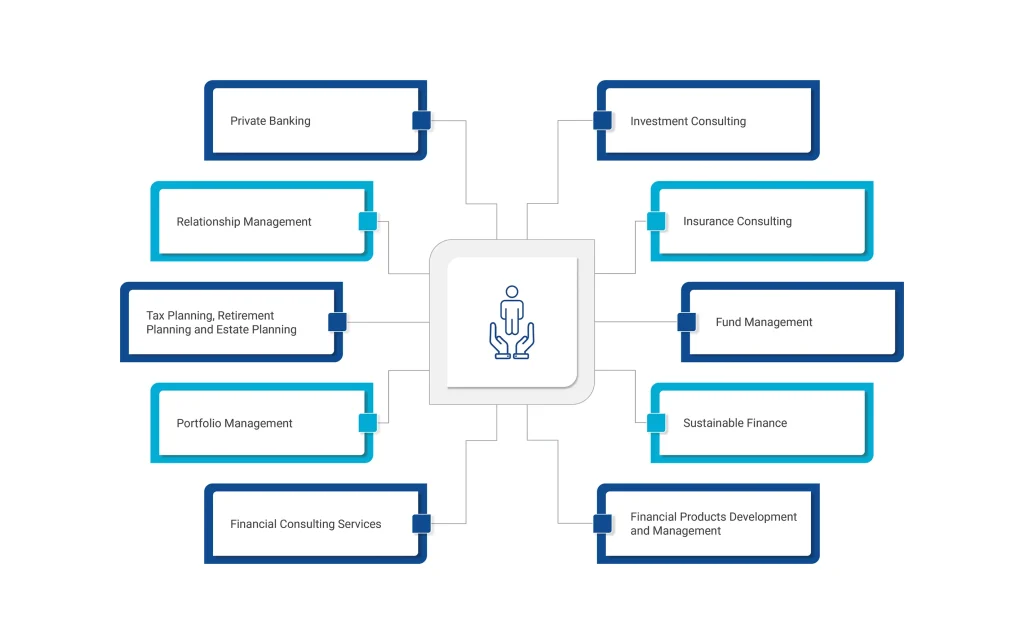

Potential Career Opportunities for CFP® Professionals

Steps to become a CFP® Professional

Register as a candidate for CFP® certification and purchase course material for one or more specialist programs

Complete the education requirement through one of two modes: Self-Study Mode or Instructor-Led Education Mode

Pass the required examinations

Meet the FPSB India ethics requirement

Obtain the relevant experience

Get certified as a CFP® Professional

Stay certified!

Pathway to Certification

Fast Track Pathway

FPSB India recognizes the need for an accelerated pathway that tests the competency of financial services professionals with specified education qualifications and relevant work experience.

Regular Pathway

Embark on your journey to becoming a globally recognized CFP® professional through the regular pathway. Gain in-depth expertise in financial planning and elevate your career with a professional certification that sets you apart in the dynamic world of personal finance.

Continuing Professional Development (CPD)

FPSB India has a Continuing Professional Development (CPD) program for CFP® professionals, ensuring they stay ahead in the evolving financial landscape. CPD is essential for enhancing expertise, staying updated on industry trends, and maintaining your CFP® certification. To support your learning journey, FPSB India offers multiple CPD opportunities like Journals, webinars, workshops, and industry events, to name a few.

Pathway to Certification

Fast Track Pathway

FPSB India recognizes the need for an accelerated pathway that tests the competency of financial services professionals with specified education qualifications and relevant work experience.

Regular Pathway

Embark on your journey to becoming a globally recognized CFP® professional through the regular pathway. Gain in-depth expertise in financial planning and elevate your career with a professional certification that sets you apart in the dynamic world of personal finance.

All About Examinations

To attain the CFP® certification, a candidate has to complete the education and examinations in the following modules

FPSB® Investment Planning Specialist

FPSB® Risk and Estate Planning Specialist

FPSB® Retirement and tax Planning Specialist

On completing the above modules, the candidate is eligible to enrol for Integrated Financial Planning -IFP where he/she has to complete the following Modules

FPSB Financial Plan Assessment | CFP® Examination

The Exams are available in the following formats:

1. Online Proctored Exams- Can be taken from Home.

2. In Person Examinations- Conducted at designated centres across the country.

After completing the Integrated Financial Planning module, the candidates are eligible to attain the prestigious CFP® certification on fulfilling

Experience and Ethics requirements.

CFP® Certification Renewal Process

If your CFP® certification is current and you wish to renew it with FPSB India for another year, please use the link below. You will be directed to the payment page, where you must confirm that you have completed your Continuing Professional Development (CPD) requirements, attest to your ethical and professional conduct during the certification period, and pay the required renewal fees to FPSB India.

CFP® professionals are required to renew their certification periodically. As part of the renewal criteria, they must complete and report 15 Continuing Professional Development (CPD) points annually before the renewal due date. Additionally, professionals holding an existing RIA license under SEBI (Investment Advisers) Regulations, 2013, must fulfill NISM accreditation criteria. This includes passing all three pathway exams and the CFP® certification exam again, or the NISM Investment Adviser Exam, at least once every three years before renewal.

*If your CFP® certification is expired, please contact [email protected] to discuss how to proceed with renewing your certification. Click HERE to know the fees for lapsed CFP® certification.

Unlock Knowledge. Stay Ahead

All About Financial Planning Education

Your essential guide to building a secure financial future, developed by FPSB India, this eBook offers practical insights and foundational knowledge to help you make informed decisions and grow in your financial journey.